What Is a Trust Loan? A Guide for California Beneficiaries

Trust beneficiaries in California tend to have a lot of questions about their financing options. Today, we’ll address one common question: What is a trust loan and how does it work?

Let’s start with the short version and expand from there. As its name implies, a trust loan provides funding to the beneficiaries of a legal trust, using real estate property as collateral. They’re also referred to as “beneficiary loans” in some cases, since the beneficiaries are the ones who receive the money.

What Is a Trust Loan?

A California trust loan is a type of loan that allows the beneficiaries to borrow against real estate assets included within the trust. With this type of financing, the property itself is used as collateral.

The funds can be used for a variety of purposes. Common uses for trust loan funding include estate taxes, medical expenses, property repairs or improvements, division of ownership, beneficiary buy-out, and more.

Now that you know what a trust loan is, let’s take a closer look at their unique features, benefits and uses.

Real Estate Backed Loans for Beneficiaries

With this financing option, the lender provides the loan directly to the trust and its beneficiaries. Depending on the structure and wording of the legal trust, the trustee might have to approve of the loan in advance. Once the loan gets approved, funding can be provided almost immediately, with the beneficiaries being responsible for the monthly payments.

In California, trust loans are commonly used by beneficiaries (e.g., siblings and heirs) who want to divide an interest in trust-owned real estate. For instance, one beneficiary might retain ownership of the real estate, while the other beneficiaries receive a cash buy-out. That’s one of several ways to use a beneficiary loan.

Lending to an Irrevocable Trust

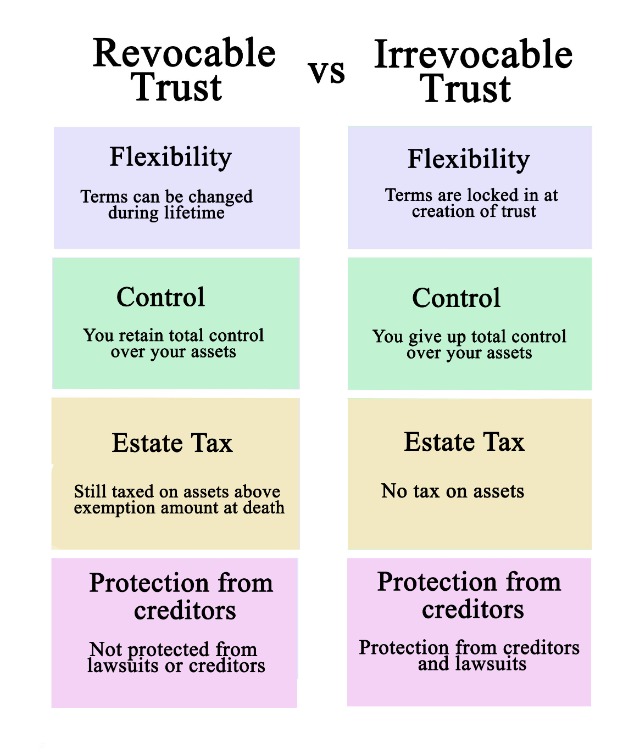

There are different versions of the trust loan in California, because there are different types of legal trusts. The most common scenario is when the lender provides funding directly to an irrevocable trust.

In California, an irrevocable trust cannot be changed or altered once the assets have been transferred into it. But it can be revoked in certain cases, if all of the beneficiaries agree on it.

When a loan is made to an irrevocable trust, the real estate assets held in the trust serve as collateral. This offers certain benefits. For instance, the borrowers typically don’t need to worry about their credit scores or personal income. With a trust loan, the lender qualifies the property that’s being used as collateral, rather than qualifying the individual borrower(s).

Usually Offered by Smaller Lenders

These loans are typically offered by hard money and private money lenders, as opposed to traditional lenders and banks. Trust loans can be fairly complex, when compared to conventional mortgage loans. This is especially true when there are multiple beneficiaries involved, and therefore more claims to the property title.

Conventional lenders, like banks and credit unions, often avoid making loans to irrevocable trusts in California. This reluctance stems from many factors, including the complexity mentioned above and the lack of a personal guarantee. Additionally, banks often refuse to offer traditional mortgages or HELOC products against real estate that’s part of an irrevocable trust.

When traditional banks and lenders do offer trust loans, they tend to have very strict underwriting guidelines, due diligence, etc. So the path to funding could involve a lot of red tape. In contrast, a private lender like Independent Lending can offer a fast and smooth approval for most California trust loans.

Bad Credit Acceptable in Many Cases

When you apply for a regular mortgage loan, the lender will analyze your credit history and score. They do this to see how you’ve borrowed and repaid money in the past, and often base their lending decision on this analysis.

But if you use a trust loan, the real estate assets held in the trust will serve as collateral. Because of this, your personal credit score becomes irrelevant.

As a private money lender in California, we base our trust loans on the value of the property securing the loan, rather than the credit history of an individual borrower. This simplifies the process and also results in a faster approval, compared to traditional lenders.

Your California Irrevocable Trust Loan Lender

When you apply for a regular mortgage loan, the lender will analyze your credit history and score. They do this to see how you’ve borrowed and repaid money in the past, and often base their lending decision on this analysis.

But if you use a trust loan, the real estate assets held in the trust will serve as collateral. Because of this, your personal credit score becomes irrelevant.

As a private money lender in California, we base our trust loans on the value of the property securing the loan, rather than the credit history of an individual borrower. This simplifies the process and also results in a faster approval, compared to traditional lenders.

Also Serving Arizona, Florida and Texas. While based in California, Independent Lending can also provide funding to clients who are located in Arizona, Florida and Texas. So please reach out to us if you need an irrevocable trust loan in one of those states. We can help you explore your financing options and choose the best path forward.