Buying an Investment Property in California With Bad Credit

Can I buy an investment property in California with bad credit?

This is a common question among some investors, and with good reason. Having poor credit can make it harder, if not impossible, to qualify for a traditional regular mortgage loan.

Fortunately, there are financing options available that can enable you to buy an investment property even with bad credit. Many California real estate investors use hard money loans to finance their purchases. Here’s what you should know about buying investment properties with a bad credit home equity loan.

Buying Investment Properties With a Bad Credit Equity Loan

Borrowers with bad credit often have a hard time qualifying for a regular mortgage loan. That’s because traditional banks and mortgage lenders base their lending decisions on the borrower’s credit history (among other factors). In short, having a bad credit score can reduce your chances of getting a loan from a traditional lender.

But California real estate investors have other options as well, and the “hard money loan” is one of them. Let’s start with a definition and move on from there.

A hard money loan is a secured loan based on the value and investment potential of the property being purchased, rather than the borrower’s creditworthiness. Real estate investors in California often use hard money loans to finance the purchase, renovation, or development of investment properties.

This option offers certain advantages, especially when it comes to the borrower’s credit score and history. With a hard money loan, the lender qualifies the property being purchased, instead of the individual borrower. As a result, these loans can be a good option for borrowers who may not qualify for a traditional mortgage due to having poor credit.

In some cases, these loans can function like a bad credit home equity loan. They allow borrowers with credit-related issues to take out a home equity loan against one property, and to use those funds to purchase an investment property.

So you’re basically using the value and equity of one home to buy another. This gives investors with past credit problems a financial “workaround” to achieve their investment goals.

Borrowers with bad credit can use hard money equity-based loans for projects expected to generate a profit, such as flipping houses or new construction. They have many uses.

Bonus: How to Improve Your Score Going Forward

If you want to buy an investment home in California but currently have bad credit, a hard money loan might be the best option. It could give you access to cash in a hurry, to facilitate your next purchase.

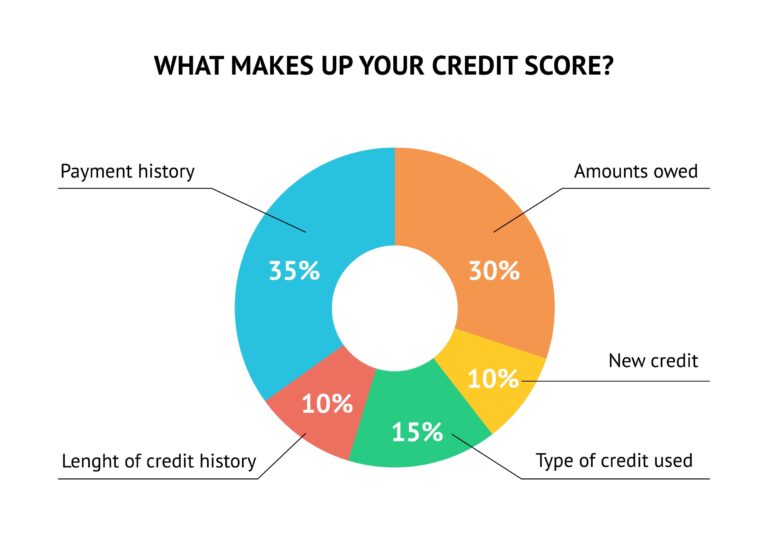

But we would be remiss not to offer some tips for improving a credit score. Here are some strategies that might help you boost your score over time. The following suggestions are based on advice provided by the credit-scoring software company FICO.

Questions? Do you have questions about using a hard money loan to buy investment properties in California? That’s our specialty! Independent Lending has 40 years of experience and serves borrowers and investors all across the Golden State. Please contact us with your financing questions or to apply for a loan.